The Silver Bullet is Missing

The “Paper” Price is Dead. Here is how to navigate the Physical Reality.

The events of this week mark the end of an era. When the CME Group announced yet another round of punitive margin hikes on silver contracts, they didn’t just “stabilise” a volatile market; they destroyed the mechanism of price discovery.

To understand the gravity of this moment, one must return to first principles. A commodity futures exchange is not a derivatives casino by accident of low delivery volume; it is a market by virtue of a single, crucial facility: the credible threat and operational pathway for physical delivery. This mechanism is not a minor feature—it is the keystone. As the CME Group itself states, physical delivery is implemented 'by design' for one critical purpose: to ensure 'convergence in pricing between the physical market and the futures market at the futures’ expiry.' It is this tether—this forced marriage of paper contract to physical metal—that legitimises the screen price as a tool for discovery, not just speculation. Sever this tether, and you haven't 'stabilised' a market; you have redefined it. The price on the screen becomes a closed-loop financial variable, a shadow divorced from the substance of the physical world. What we are witnessing is not a market correction, but the failure of this fundamental design principle under the weight of material reality.

For decades, the premise of the futures market was simple: Speculators provided liquidity, but the threat of physical delivery kept the price honest. If the price on the screen drifted too far from reality, a participant could stand for delivery and arbitrage the gap.

That link has been severed. By raising margin requirements to levels that force liquidation, the exchange has effectively closed the casino to anyone but the house. The “Price” you see on the screen is no longer the cost of silver; it is the cost of exit.

The evidence is in the spread. On the final trading afternoon of 2025, the market quoted a Bid of $75 and an Ask of $85—a chasm of volatility—on virtually zero volume. This is not a market clearing; it is a standoff. Sellers possess metal they will not release, and buyers possess cash that has lost its purchasing power.

This creates a bifurcation. There is the Screen Price, a managed fiction currently hovering around $75/oz, and there is the Street Price, the opaque, infinitely higher cost to actually acquire the conductive metal required to run the 21st century. This price now includes a massive “Trust Tax”—the cost of assaying, securing, and verifying metal in a market flooded with desperate buyers and opportunistic fraud. When the exchange fails, the purity of the supply chain collapses with it.

The architecture of a commodity market is simple: the promise of delivery binds paper to physics. Remove that promise, and you don’t have a ‘volatile’ market—you have a different entity entirely. The price on the screen is no longer discovered; it is merely administered.

This disconnect exposes the lie at the heart of the “Green Transition.” We built an entire industrial strategy on the assumption that material inputs would always be available at the Screen Price.

The Liquidation of History

We failed to realise that this low price was a thermodynamic anomaly, subsidised by the liquidation of history. For decades, the market liquidated the accumulated ‘treasure’ of the past—sterling coinage, cutlery, candlesticks—simply because melting a pre-refined heirloom is thermodynamically cheaper than crushing a ton of rock.

This process of liquidating high-grade capital stock to subsidize low-grade flows is the thermodynamic engine of the crisis I first identified in The Thermodynamic Blind Spot as a consequence of my SETE model. We are now witnessing its first-order material consequence.

We mistook the drawdown of this finite capital stock for a sustainable flow of production. The market followed the path of least resistance: why mine 0.02% ore when you can melt 92.5% spoons? But that stock is now gone. We have burned the furniture to heat the house, and now we must face the winter with nothing but geology.

Now that the Silver Bullet is missing, the valuation models for the entire sector are broken. Investors must now perform a brutal re-evaluation of their portfolios. We are moving from a world of infinite scaling to one of material constraints. Here is the Physical Audit—a framework for assessing solvency in a resource-constrained world.

1. The Vulnerability Index: Who Dies First?

The first casualties will be the companies that believed the simulation. They built business models dependent on infinite, cheap silver flow and are now effectively “short” physical reality.

The most critical metric here is the Silver-to-Sales Ratio (Ag/Rev)—the milligrams of silver required to generate £1 (or $1) of revenue. This figure exposes the companies whose gross margins are most sensitive to a physical price spike.

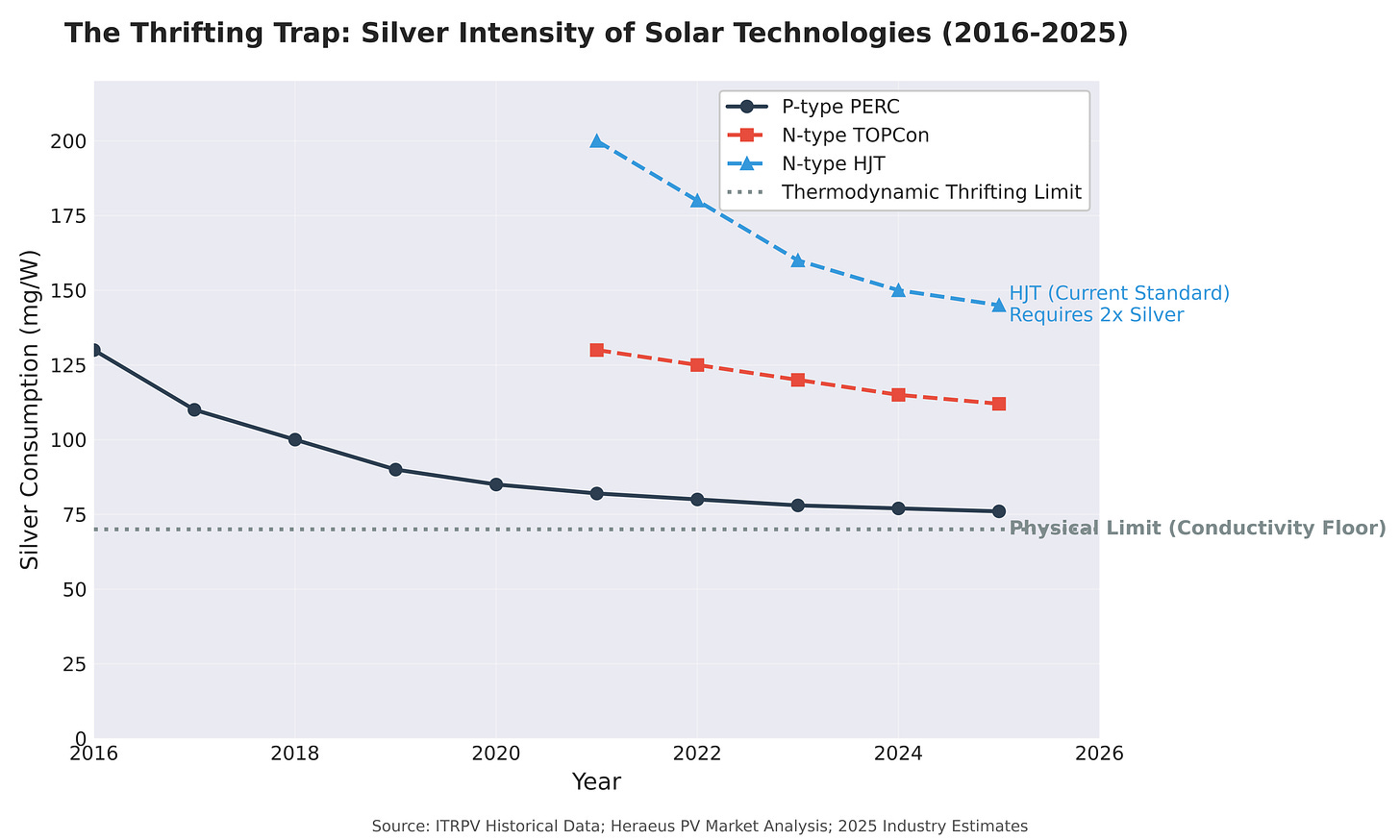

The “Thrifting Limit” Indicator

Definition: Has the company already engineered out the “easy” silver?

The Trap: Tesla and other EV majors already reduced silver content by roughly 30-40% between 2020 and 2024, hitting the thermodynamic floor (conductivity limits). Further reductions risk fire safety and performance failures.

Be sceptical of announcements promising a switch to copper. Copper oxide is an insulator; silver oxide is a conductor. In high-voltage, high-reliability electronics, physics does not negotiate.

2. The New Kings: Who Owns the Rock?

In a shortage, flow (production) matters less than stock (reserves in the ground). Capital will inevitably rotate from the “Users of Entropy” (Tech) to the “Owners of Entropy” (Miners).

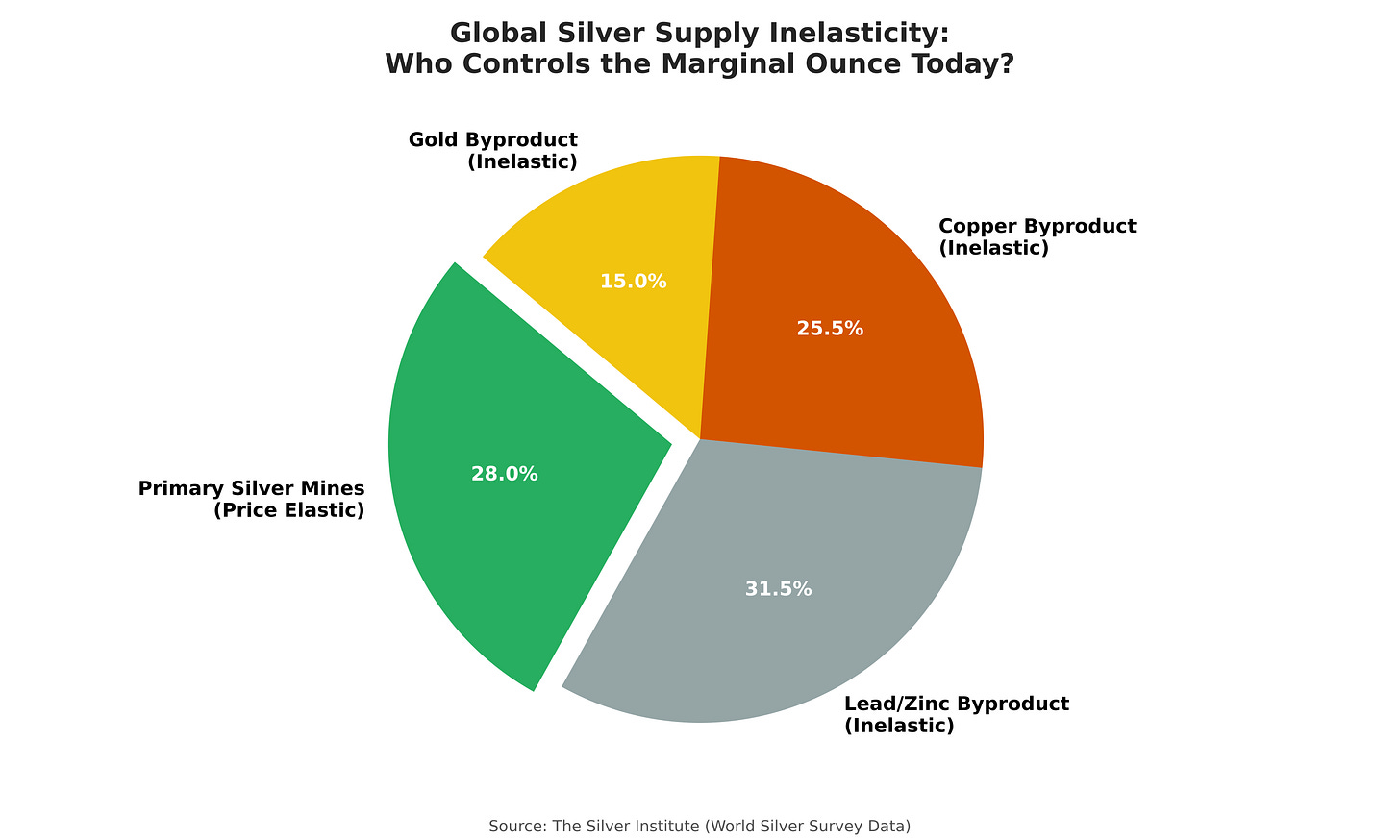

The key metric for this sector is the Reserve Life Index (RLI). Companies with long-life mines (RLI > 15 years) transform from cyclical plays into strategic assets, while short-life mines are merely depleting annuities. Investors must look for Primary Silver Miners. Because ~72% of silver is produced as a byproduct of copper or zinc mining, global supply is notoriously inelastic—you cannot simply mine more silver without crashing the copper market. Primary miners control the marginal ounce.

However, geology must be weighed against the Sovereign Risk Multiplier. As per my analysis in The Global Landlord, nations are beginning to hoard resources. China’s Export Licensing System (active 1st Jan) is just the first domino. A mine in Mexico or Peru is subject to export bans, whereas assets in a “Safe Jurisdiction” (if one still exists in a dollar-vacuum world) will command a massive premium.

Investors must also consider “Internal Confiscation Risk.” The CME’s margin hikes are a form of soft confiscation—forcing holders to liquidate their claims before they can take delivery. If silver is subsequently designated a strategic material for national security (missiles/grid), governments in the West may move from soft to hard measures, emulating Executive Order 6102. Unlike the monetary gold seizure of 1933, this would be an industrial seizure. The likely targets are not private coin collections (high entropy to collect), but the concentrated stockpiles in ETFs and custodial vaults. If you do not hold it, you do not own it; you merely own a claim that can be liquidated at a statutory price.

3. The Scavengers: Urban Mining

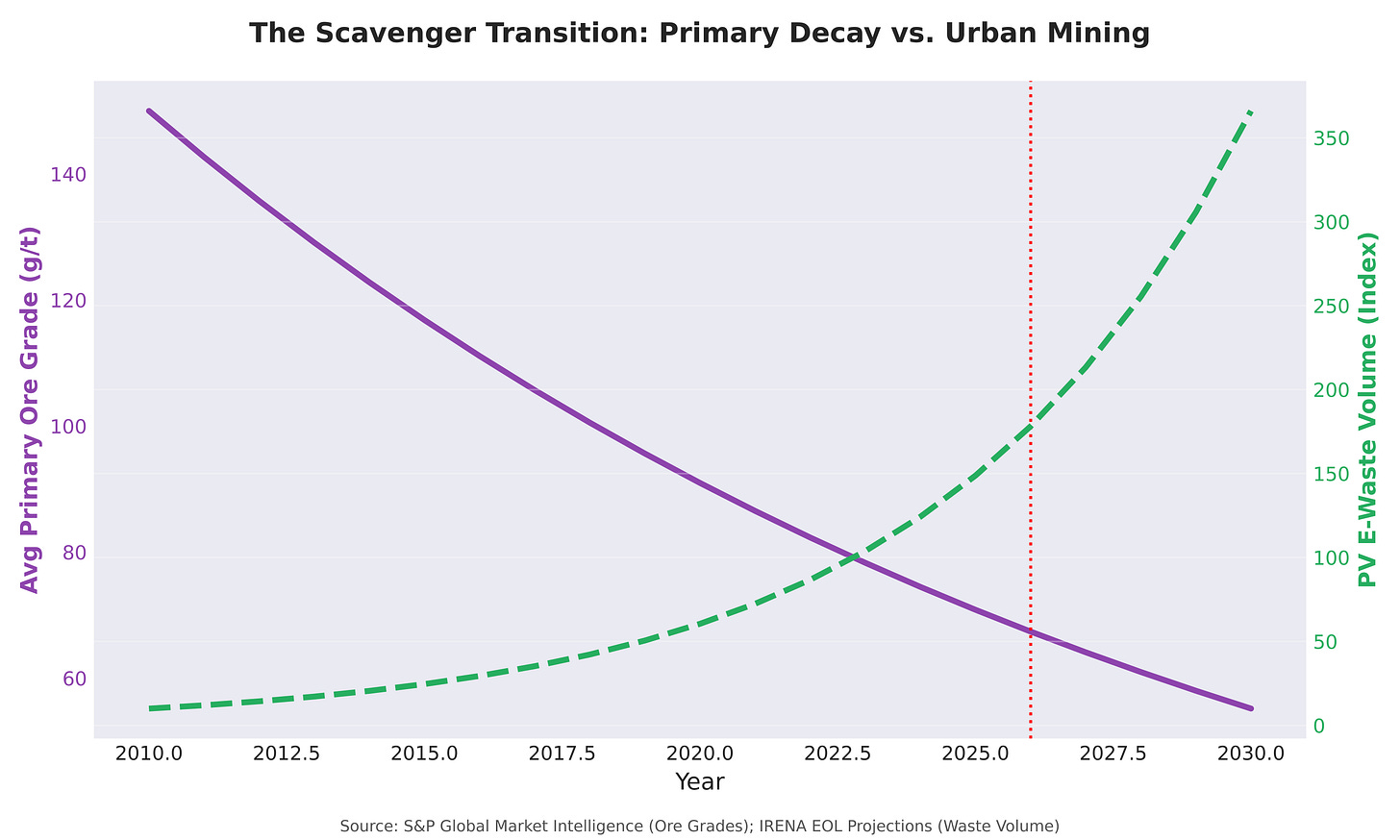

If Primary Mining hits the ERoEI cliff (declining ore grades), the only remaining high-grade deposit is the Technosphere itself.

The “Above-Ground Stocks” contained in the millions of solar panels installed in the 2010s are approaching end-of-life, making Recycling Yield Efficiency a critical metric.

This is the new frontier of scavenging. Unlike the “Easy Scavenging” of the 20th century (melting coins), which was low-tech and high-yield, the “Hard Scavenging” of the 21st century involves recovering nano-particles from conductive paste. Companies specialising in high-efficiency recovery (hydrometallurgy) will become the new “Midstream,” as they are the only entities capable of turning a dead solar panel back into a live asset without digging a hole. This represents the only “Green” sector that aligns with the physics of the future.

4. The Mandate Trap: When Law Meets Geology

We must also consider the political dimension. These technologies are not merely consumer choices; they are statutory obligations. Governments across the G7 have mandated the transition through Net Zero targets, ICE bans, and renewable portfolio standards.

This creates a “Mandate Trap.” The State has legislated the outcome (Solar/EVs) but ignored the input (Silver).

When the physical shortage bites, governments will likely attempt to intervene. They will offer subsidies, price caps, or emergency procurement funds, trying to use Grand Agency (M_I) to override Material Reality (M_M). But money does not compensate for missing silver bullets. You cannot print conductivity.

If the government subsidises the cost of silver, they simply bid the price to infinity against other industrial users like the military or electronics sectors.

If they cap the price, supply vanishes entirely into the black market or strategic stockpiles of rival nations.

This explains the sudden militarisation of industrial policy across the West. A “War Economy” is the only political structure capable of suspending market pricing to seize critical resources. But for energy-importing regions like Europe, this pivot is delusional. A military build-up precludes a functional domestic economy because it competes for the same scarce inputs. In a constrained system, every tank built is a factory closed; every strategic stockpile filled is a civilian supply chain broken. This is less than a zero-sum game; it is active economic cannibalism.

The collision between Mandatory Demand and Geologic Scarcity guarantees a crisis of governance. The laws of the land now contradict the laws of physics.

The Simulation is Over

The market is about to learn that Price is not the same as Availability. In the old world, a rising price signalled supply to come online. In the New World of the Singularity, price goes up, but supply stays flat against geologic and political limits, leading purely to demand destruction.

With China’s new export policy coming coming into effect tomorrow (1st Jan), 70% of the world's refined silver effectively leaves the global market. The arbitrage that once corrected prices is dead. The 'premium' won't be a surcharge—it will become the price. The screen quote will be a historical artifact, a joke told in a world that can no longer afford to laugh.

The geopolitical fracture ensures that the price discovery mechanism—already crippled by the exchange's financial interventions—has no physical market left to discover. The 'Singularity' is not coming; it is here.

This 'Singularity'—where price signals fail because supply is bounded by geology and politics—is the crisis point of the Resource Entropy model. The silver market is its first unambiguous signal.

The “Paper Silver” market has died. The “Physical Reality” market has just opened. Gamble safely.

Excellent analysis, thank you! The turn toward military buildup actually preceded the silver market shock but certainly exacerbates it. For the collective West, russophobia has been a persistent goal for a century, and for Europe since WW-II. To focus their populace away from their direct needs, they imagine the next geopolitical “threat.” But Europe without access to cheap energy is a failed state. What you say here is most important: “A military build-up precludes a functional domestic economy because it competes for the same scarce inputs.” Not only that, but producing armaments is false economic benefit because it is wasting resources for destructive purposes. Just as you can’t print silver, you can’t bomb a city into existence.