The Dollar Vacuum: Why Multipolarity is a Mirage

The US isn’t “losing” its privilege. It is cannibalising the global system to feed the Singularity.

If you follow the mainstream financial press—from Bloomberg to the Financial Times—you are currently being fed a seductive narrative about the decline of the American Empire. The story goes like this: The United States, by weaponising the dollar and threatening aggressive tariffs, has overplayed its hand. In response, the rest of the world is making a rational, “multipolar” choice to exit the system, shifting seamlessly into gold, the Yuan, or a basket of BRICS currencies.

This narrative is comforting because it preserves the illusion of agency. It suggests that the current geopolitical shift is a negotiation—a changing of the guard where one order politely steps back and another steps forward.

This premise is demonstrably false. It relies on the “Strong Enlightenment” fallacy that political economy is a matter of rational human choice, independent of biophysical reality.

When empires fail, they do not simply retire; they consume their periphery. The US is no different. If we look at the system through the lens of the Resource Entropy Singularity (RES), we see that the United States is not “losing” the dollar system. It is violently sucking the liquidity out of it. The periphery is not “exiting”; it is being metabolised.

Nature abhors a vacuum, but the global economy is about to be forced into one.

The Mirage of Voluntary Exit

The recent analysis circulating in media outlets argues that central banks are selling Treasuries and buying gold to “derisk.” They interpret the 10% tariff threat as a blunder that pushes allies away.

This view assumes that the global economy is a marketplace of ideas where nations can simply shop for a new reserve currency if they don’t like the customer service of the old one. It fails to account for Stock vs. Flow.

You can trade in Yuan (Flow), but you owe in Dollars (Stock).

The global economy is built on a massive pile of Eurodollar debt—dollar-denominated liabilities held outside the United States. To service this debt, the world requires a constant inflow of dollars. Historically, the US provided this liquidity through its trade deficit (buying the world’s goods).

The Physics of Suction: The Tariff as Margin Call

When the US administration imposes a universal 10% tariff while simultaneously “doubling down” on domestic industrial policy, it is not “isolating” itself in the political sense. It is executing a margin call on the global economy.

Here is the thermodynamic mechanism:

The Tariff: Increases the cost of accessing the US market, reducing the net flow of dollars out of the US.

The Debt: The rest of the world still needs dollars to service its massive Eurodollar liabilities.

The Squeeze: With fewer dollars flowing out, but the demand for dollars remaining high (to pay debt), the “price” of liquidity spikes.

This does not create an “exit.” It creates a vacuum. As liquidity dries up, capital in the periphery (Europe, the Global South, and even China) does not “migrate” to a competitor; it gets sucked into the US core in a desperate bid for yield and safety, or it is annihilated in a wave of defaults.

Historical Precedent: Metabolism vs. Handover

Critics often point to the transition from the British Empire to the US as proof of a “smooth handover.” They assume the US will do the same for a “multipolar” successor. This misses the metabolic reality of the 20th century.

Britain did not gracefully retire. Between 1914 and 1945, Britain violently metabolised its periphery to keep its heart beating. It liquidated its entire overseas portfolio—selling off US railways and Latin American infrastructure—and drained the Indian treasury to pay for the “Maintenance Power” (oil, steel, munitions) required to fight entropic decay.

The difference today is that there is no hyper-industrial successor ready to accept the torch. The US is not passing the flame; it is burning the furniture. It is stripping the assets of Germany, Japan, and the Global South because there are no new frontiers left to exploit.

Evidence of the Singularity: The Real Data (2024–2025)

The “Suction” dynamic is not theoretical; it is visible in the hard data reported throughout 2024 and 2025. The causal chain—Mechanism, Impact, Stress—is clearly defined in the official statistics.

The following data do not “prove” the SETE model; they demonstrate that observed flows are consistent with a constraint-driven, stock–flow–asymmetric system under rising entropic pressure.

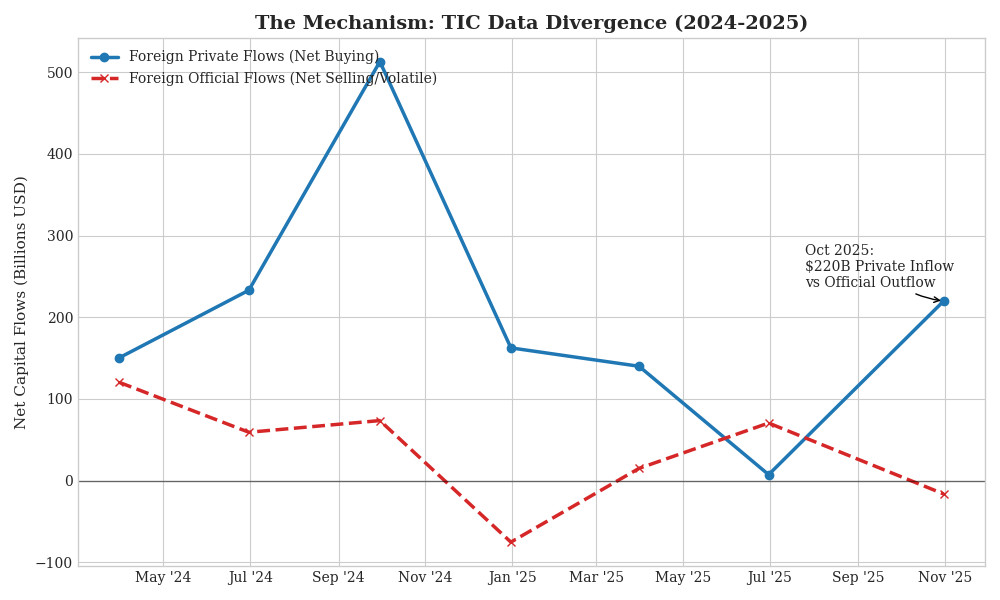

1. The Mechanism: TIC Data Divergence

The Treasury International Capital (TIC) reports from late 2025 reveal the smoking gun. We see a violent bifurcation between the people (Private) and the state (Official).

The Private Flight: In October 2025 alone, foreign private investors purchased a net $220.0 billion in US assets. This follows a Q3 trend where private inflows dominated. Private capital is fleeing the industrial decay of Europe and Asia to seek safety in the US core.

The Official Liquidation: Simultaneously, foreign official institutions (Central Banks) were net sellers (outflows of $16.4 billion in October 2025, following massive outflows in Dec 2024).

Conclusion: This is not a coordinated exit; it is a chaotic run on the bank. Governments are selling reserves to survive the vacuum, while private capital is being sucked into the US at record speed.

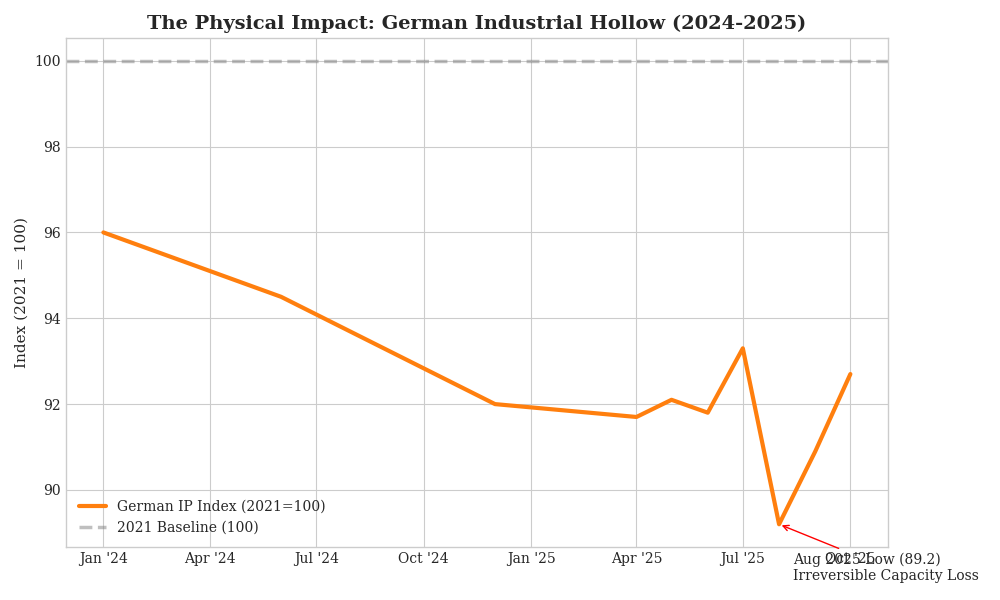

2. The Physical Impact: The “German Hollow”

The capital vacuum has immediate thermodynamic consequences. As liquidity flees the periphery, it strips the capacity for work.

The data: Germany’s Industrial Production Index (2021=100) crashed to a low of 89.2 in August 2025. While there was a minor “dead cat bounce” in October (to 92.7), the trend is a structural ratchet downwards—a 4.8% decline in 2024 followed by continued volatility in 2025.

Hysteresis: This represents the permanent destruction of industrial capacity. German factories are not “pausing”; they are closing to feed the US metabolic demand.

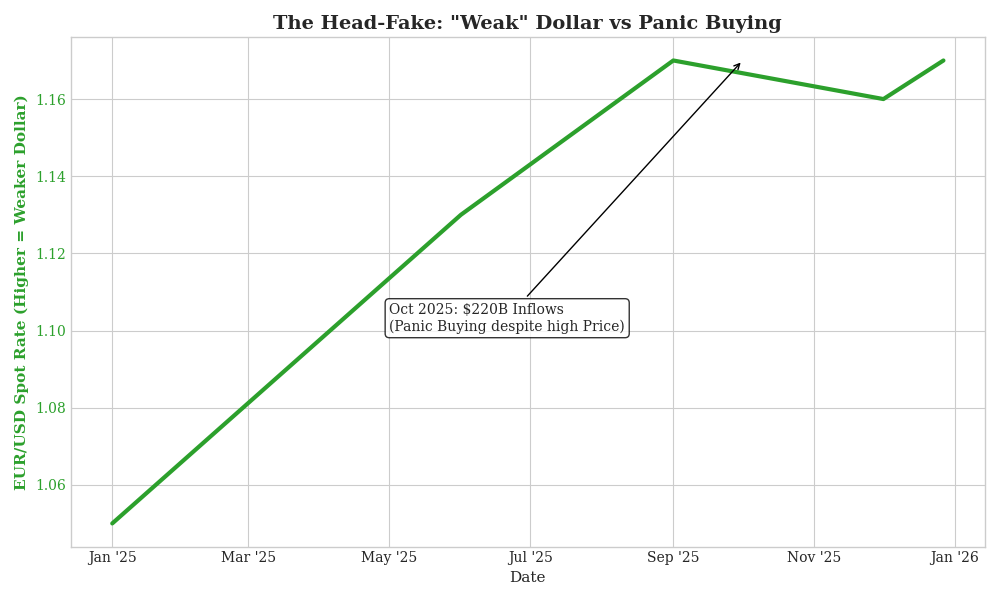

3. The Financial Stress: The “Head-Fake” Divergence

Perhaps the most dangerous signal is the divergence between price and flow.

The Head-Fake: Throughout late 2025, the Euro actually rose against the Dollar (reaching ~$1.17). Mainstream pundits hailed this as the “end of the strong dollar.”

The Reality: Yet, during this very period of “dollar weakness,” private inflows into the US accelerated to record highs ($220B in Oct).

Conclusion: This proves the shortage is structural. Investors are ignoring the price signal and rushing into the dollar for safety and liquidity. The vacuum is pulling capital in despite the exchange rate, a sign of extreme systemic stress.

The Thermodynamics of the Rally: Latent Heat and Hysteresis

Observers point to the year-end market rally in 2025—despite the geopolitical fracturing—as evidence of US economic resilience or “American Exceptionalism.” Through the lens of the SETE model, this rally is not a sign of health; it is a thermodynamic signature of destruction.

1. Latent Heat of Liquidation

In physics, Latent Heat is the energy released or absorbed during a phase change (e.g., steam to water) without a change in temperature. The global economy is currently undergoing a violent phase change: the liquidation of the periphery.

To meet the US margin call, foreign nations and firms are forced to liquidate real assets—factories, infrastructure, and commodity stocks—converting them into liquid capital (dollars) to service debt or flee to safety.

The Phase Change: Solid Capital (Periphery) → Liquid Capital (US Flows).

The Rally: This massive release of liquidity flows into the US equity market. The “heat” driving the US rally is actually the energy released by the decomposition of the European and Asian industrial base. The US market is glowing from the heat of burning the furniture of its allies.

2. Hysteresis: The Broken Elasticity

Mainstream economists assume this is cyclical—that once rates stabilise or tariffs are adjusted, the flows will reverse, and the global order will “snap back” to equilibrium. This violates the concept of Hysteresis.

Hysteresis describes systems where the state depends on its history; the return path is not the same as the forward path. The destruction of the periphery is path-dependent and irreversible.

Irreversible Strip-Mining: Once a German industrial complex is shuttered and its machinery auctioned to pay dollar debts, it does not reopen when the dollar weakens. The physical gradient has been destroyed.

The Ratchet Effect: The US Vacuum is stripping the capacity for future value creation from the periphery. There is no elasticity left. The system cannot “cycle” back because the biophysical structure that supported the old cycle has been consumed to feed the US core’s immediate metabolic needs.

A SETE Primer: The Physics of Political Economy

To understand why the system cannot simply “reset,” we must look at the Socio-Economic Thermodynamic Entropy (SETE) model. This framework treats the political economy not as a spreadsheet of voluntary transactions, but as a physical body orbiting a biophysical limit.

1. Resource Entropy Singularity (S_crit)

This is the “Black Hole” at the center of the system. It is the critical point where the biophysical cost of maintaining our society exceeds the total energy available to run it. Once crossed, systemic collapse is non-negotiable.

2. Inertial Mass (M)

The economy is not weightless. It has mass that resists change. This mass is composed of two things:

Material Mass (M_M): The trillions of dollars of fixed infrastructure (cities, grids, ports) that lock us into high-carbon pathways.

Ideological Mass (M_I): The institutional weight of accumulated debt, legal contracts, and the “Strong Enlightenment” belief in endless growth. This invisible mass makes it politically impossible to turn the ship.

3. Entropic Drag (F_drag)

Just as a car needs fuel to move against air resistance, our economy needs energy just to exist against decay. This is the friction of complexity. As resources degrade (ore grades drop, soil erodes, climate instability rises), this drag force increases exponentially.

4. Maintenance Power (P_maint)

This is the energy we burn just to stand still. Before we can build anything new or “grow,” we must pay the energy bill to fight Entropic Drag. As we approach the Singularity, this maintenance cost swallows the entire economy.

The Cannibal Core: Thermodynamics of the RES

The US system is behaving this way because alternative trajectories are no longer energetically or politically accessible. It is not merely bad policy or Trumpian erraticism. It is a physical necessity driven by these SETE dynamics.

The US political economy acts as an entity with massive Inertial Mass (M). To maintain this structure against rising Entropic Drag (F_drag), the US requires an immense, accelerating input of Maintenance Power (P_maint).

For decades, the US satisfied this hunger by printing dollars (exchanging IOUs for real resources). Now, as we approach the Singularity, the “easy” resources are gone (Energetic Divergence). The cost of maintenance is skyrocketing.

The US can no longer afford to subsidise the global order. It must now cannibalise it.

The “suction” is the US economy frantically drawing in every available unit of Exergy (Ex_in)—capital, industrial capacity, and resources—from the periphery to keep its own entropic engine running. It is stripping the assets of its allies to feed the furnace in the core.

Nature Abhors a Vacuum

The “multipolar” optimists argue that as the dollar recedes, the BRICS nations will build a new order in the space left behind.

But the “Dollar Vacuum” leaves no space. It leaves a crater.

If the US sucks the liquidity out of Europe and the Global South, it destroys the mechanism of exchange that allows those regions to function. You cannot build a new “Gold Standard” or “Yuan System” on top of a collapsed real economy.

The Liquidity Desert: Without the dollar flow, trade in the periphery seizes up.

The Internal Contradiction: This is the fatal flaw of the US strategy. Capitalism requires a periphery to extract from. By sucking the periphery dry to satisfy its immediate metabolic needs (P_maint), the US destroys the very host organism it feeds upon.

The “vacuum” is not an empty room waiting to be redecorated by China. It is a singularity—a collapse of the complex adaptive system into a lower energy state.

The Singularity Does Not Negotiate

If a non-dollar settlement system were able to absorb legacy dollar liabilities without inducing deflationary collapse in the periphery, the vacuum thesis would be wrong. That condition would require a transition governed by choice rather than constraint.

However, the Bloomberg narrative is a “Strong Enlightenment” fantasy—a belief that we can rationally manage the transition to a new equilibrium.

The reality is thermodynamic. The US is trapped in a Resource Entropy Singularity. It is thrashing. The “Dollar Vacuum” is the sound of a dying star consuming its own planets in a desperate bid to keep burning.

We are not heading for a multipolar tea party. We are heading for the event horizon.

Massive defaults beginning in March. Worldwide central banks will discover that they have vaults full of useless assets: gold bars and T-Bills, supposedly constituting their foreign currency reserves for facilitating trade. The US$ was the intermediary in every forex swap, noting can replace that. Most countries need energy imports and will suffer greatly when trade collapses.

The U.S. dollar is heading toward a crisis because it's no longer anchored to real savings, production, or market discipline. Decades of central-bank money creation, deficit spending, and credit expansion have diluted the dollar’s purchasing power, masking real economic weakness behind rising asset prices and debt. This artificial boom can't last. As more dollars are created to paper over past failures, confidence in the currency will erode, prices will rise, and people will begin to flee the dollar for real goods and harder monies like gold and silver. The result isn't just inflation, but the destruction of the dollar’s value itself.